Ca$h in on Culture

Prediction News Network delivers clear context and insight on tradable events, informed both by the event itself and the current price.

Trending: The expanded CFB Playoffs saw some lopsided games yesterday. Who will win it all?

Today’s Rundown

What’s Happening: New England heads into Baltimore with a simple mandate: win and you’re in. At 11–3, the Patriots can lock up their first postseason berth since 2021 and keep AFC East title hopes alive. QB Drake Maye enters off a volatile Bills loss that featured explosive runs from TreVeyon Henderson, a revived Rhamondre Stevenson, and two Maye rushing TDs — but also a defense gutted by injuries and poor tackling.

Baltimore leans on Derrick Henry’s 1,122 yards and 10 TDs while hoping Lamar Jackson recaptures last week’s sharper form. Zay Flowers is the Ravens’ all-levels threat, and Mark Andrews remains a red-zone problem.

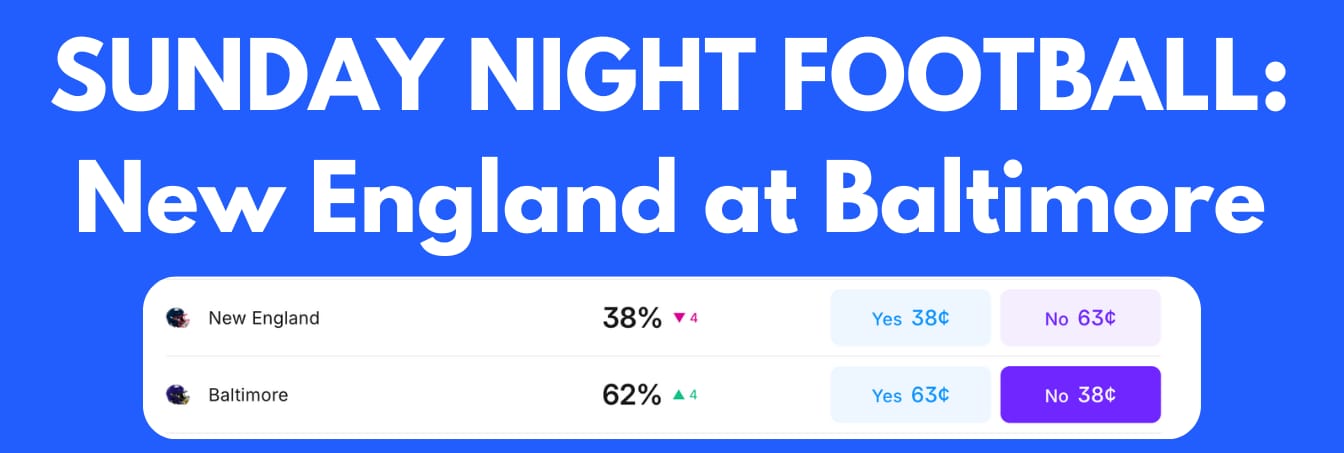

Market Pricing

New England: 38¢

Baltimore: 62¢

Volume: $2,207,133 on Kalshi

Game time: 8:20 p.m. ET

Scenarios

If the Patriots’ ground game replicates last week’s edge success, Henderson + Stevenson can keep Maye ahead of the chains and avoid the Ravens’ exotic third-down blitz looks — turning this into a neutral-script shootout New England can win.

If Henry dictates tempo early, the Patriots’ depleted front (still missing Spillane, thin at DT) risks collapsing into heavy boxes, unlocking Lamar’s deep shots to Flowers and Andrews. That flips the game state hard toward Baltimore.

Trading Takeaway: Baltimore’s pricing reflects market skepticism about New England’s defensive health more than quarterback play — Maye has real upside against this coverage structure if protected. Liquidity is strong, spreads tight, and the tilt in pricing feels slightly overextended toward Baltimore given the Patriots’ explosive-run advantage and deep-shot matchup.

Lean: New England Yes at 38¢ — undervalued relative to win-and-in motivation.

Sponsored

Here’s an un-boring way to invest that billionaires have quietly leveraged for decades

If you have enough money that you think about buckets for your capital…

Ever invest in something you know will have low returns—just for the sake of diversifying?

CDs… Bonds… REITs… :(

Sure, these “boring” investments have some merits. But you probably overlooked one historically exclusive asset class:

It’s been famously leveraged by billionaires like Bezos and Gates, but just never been widely accessible until now.

It outpaced the S&P 500 (!) overall WITH low correlation to stocks, 1995 to 2025.*

It’s not private equity or real estate. Surprisingly, it’s postwar and contemporary art.

And since 2019, over 70,000 people have started investing in SHARES of artworks featuring legends like Banksy, Basquiat, and Picasso through a platform called Masterworks.

23 exits to date

$1,245,000,000+ invested

Annualized net returns like 17.6%, 17.8%, and 21.5%

My subscribers can SKIP their waitlist and invest in blue-chip art.

Investing involves risk. Past performance not indicative of future returns. Reg A disclosures at masterworks.com/cd

What’s Happening: 28 Years Later: The Bone Temple — the middle chapter of Danny Boyle & Alex Garland’s new trilogy — is rolling into release with surging critic acclaim and a growing gap between critics and audiences. Critics call it “beautifully chaotic,” “one of the best horror films of the decade,” and a daring evolution of the franchise’s lore. Ralph Fiennes and Jack O’Connell are drawing standout praise.

Audience reactions, however, are far more mixed: sharp tonal pivots, divisive ending, and marketing mismatch (trailer sells horror; film delivers cult-psychosis arthouse chaos). This split mirrors 28 Years Later’s pattern — critics thrilled, general viewers split — but the critic wave for Bone Temple is even stronger.

Market Pricing

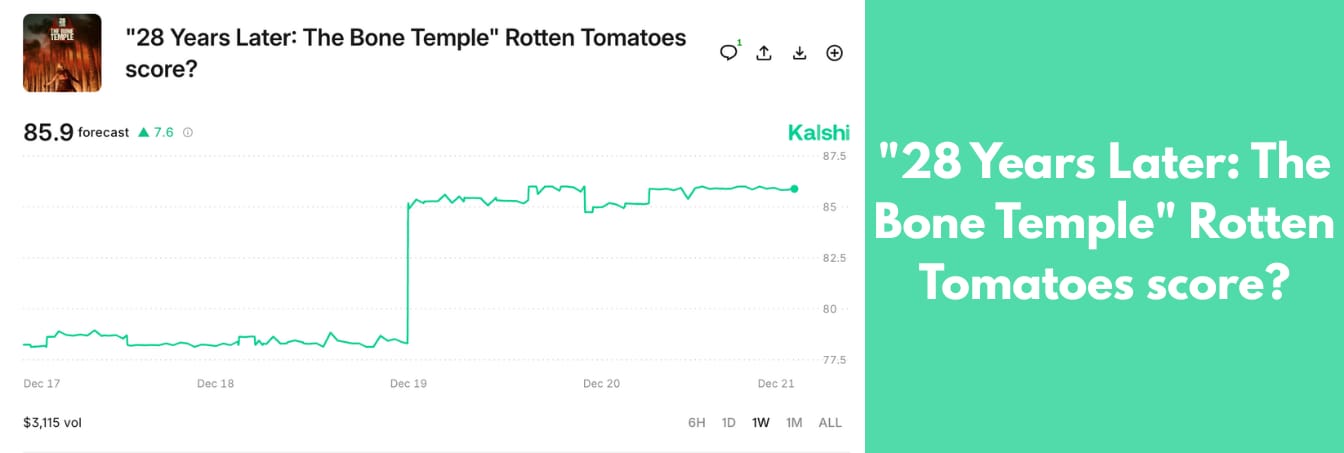

Above 80: 69% — Yes 77¢, No 31¢

Above 85: 57% — Yes 56¢, No 49¢

Above 90: 22% — Yes 28¢, No 78¢

Volume: ~$3,115 on Kalshi.

Line movement: Markets have aggressively repriced upward since the first wave of perfect-score reactions. Forecast stabilized around 85.9, up +7.6, with a clean upward regime shift on Dec. 19.

Resolution: Jan 19th, 2026 at 10:00 AM ET

Scenarios

If critics remain unanimous through the final review dump, the film should comfortably clear the 85% line. Early negative reviews barely dented the score, and the middle-film buzz (“exactly how you do a trilogy midpoint”) suggests strong late-cycle reinforcement.

If the review mix broadens once mainstream outlets and genre critics file, expect a soft drift down. Tonal whiplash, cult-centric storytelling, and that extremely divisive ending give critics plenty of angles to shave points even while praising ambition.

Trading Takeaway: Momentum is firmly with the upside: early critic unanimity + strong global press reactions + the “Boyle/Garland return to form” narrative. The critic/audience divide doesn’t threaten Rotten Tomatoes critic percentage. Liquidity is light but directional: Above 85 at 56¢ still looks mispriced to the low side.

Call: Long Above 85 (Yes 56¢)

What’s Happening: Toronto heads into Barclays after a flat 96-112 home loss to Boston, their offense sputtering without RJ Barrett and with Jakob Poeltl questionable. The Raptors have still banked two recent road wins and own this matchup historically—five straight over Brooklyn and both meetings this season by identical 119-109 margins.

Brooklyn is coming off a 95-106 loss to Miami but has quietly stabilized: four wins in their last seven and improved defensive resistance. Michael Porter Jr. remains the offensive engine (25.7 PPG), with Nic Claxton supplying efficient interior scoring and playmaking. Pace projects slow (24th vs. 27th), and both teams trend Under in Eastern matchups.

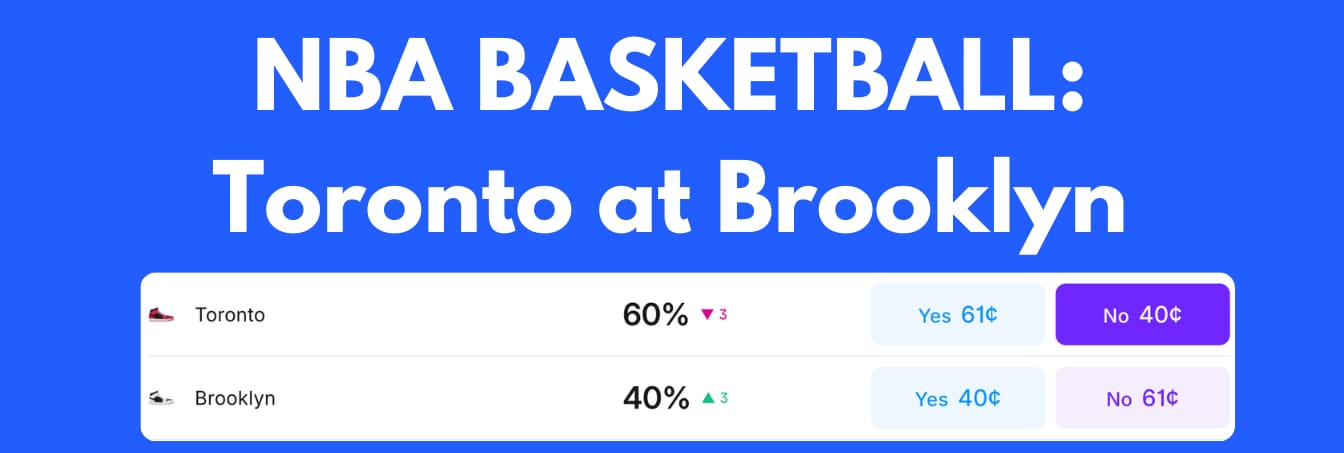

Market Pricing

Toronto: 60¢

Brooklyn: 40¢

Volume: ~$82,000 traded

Game time: 6:00 p.m. ET

Scenarios

If Toronto’s half-court creation stabilizes without Barrett—Ingram + Barnes initiating and Quickley dictating pace—they can lean on a top-half defensive profile and repeat their earlier wins. Raptors’ advantage comes through efficiency: 48% FG, 36% from deep.

If Brooklyn’s offense clears its floor—getting secondary scoring from Clowney, Demin, and Claxton while MPJ pushes 25+—the Nets can drag this into a low-tempo grinder where Toronto’s back-to-back fatigue becomes decisive. Nets have covered +3.5 in 3 of last 5 at home.

Trading Takeaway

Toronto is the mathematically stronger team, but recent form is softer than the 60¢ price suggests. Brooklyn’s net rating over the last 10 games is materially better, and matchup history—though Toronto-leaning—overstates the gap given current injuries.

Lean: Brooklyn Yes at 40¢ — pricing undervalues the Nets’ improved play and Toronto’s back-to-back drag.

🏆 Today’s Games

🏈 NFL (Sunday, December 21)

1:00 PM EST

Chargers (10–4) vs Cowboys (6–7) — LAC 48¢, DAL 53¢

Bengals (4–10) vs Dolphins (6–8) — CIN 65¢, MIA 36¢

Chiefs (6–8) vs Titans (2–12) — KC 62¢, TEN 39¢

Vikings (6–8) vs Giants (2–12) — MIN 58¢, NYG 43¢

Jets (3–11) vs Saints (4–10) — NYJ 28¢, NO 73¢

Buccaneers (7–7) vs Panthers (7–7) — TB 59¢, CAR 42¢

Bills (10–4) vs Browns (3–11) — BUF 84¢, CLE 17¢

4:05 PM EST

Falcons (5–9) vs Cardinals (3–11) — ATL 59¢, ARI 42¢

Jaguars (10–4) vs Broncos (12–2) — JAX 37¢, DEN 64¢

4:25 PM EST

Steelers (8–6) vs Lions (8–6) — PIT 25¢, DET 76¢

Raiders (2–12) vs Texans (9–5) — LV 11¢, HOU 90¢

8:20 PM EST

Patriots (11–3) vs Ravens (7–7) — NE 37¢, BAL 64¢

🏀 NBA (Sunday, December 21)

3:30 PM EST

Bulls (12–15) vs Hawks (15–14) — CHI 38¢, ATL 63¢

6:00 PM EST

Raptors (17–12) vs Nets (7–19) — TOR 60¢, BKN 41¢

Heat (15–13) vs Knicks (19–8) — MIA 28¢, NYK 73¢

7:00 PM EST

Spurs (20–7) vs Wizards (5–21) — SAS 90¢, WAS 11¢

Bucks (11–17) vs Timberwolves (18–10) — MIL 17¢, MIN 84¢

10:00 PM EST

Rockets (17–8) vs Kings (6–22) — HOU 84¢, SAC 17¢

🏒 NHL (Sunday, December 21)

1:00 PM EST

Capitals (19–12) vs Red Wings (20–13) — WSH 50¢, DET 51¢

6:00 PM EST

Avalanche (25–2) vs Wild (22–9) — COL 60¢, MIN 41¢

7:00 PM EST

Canadiens (19–12) vs Penguins (14–11) — MON 49¢, PIT 52¢

Senators (17–13) vs Bruins (20–16) — OTT 57¢, BOS 44¢

Maple Leafs (15–14) vs Stars (24–7) — TOR 34¢, DAL 67¢

Rangers (18–15) vs Predators (14–16) — NYR 52¢, NSH 49¢

Sabres (16–14) vs Devils (20–14) — BUF 44¢, NJ 57¢

Jets (15–17) vs Utah (17–17) — WPG 49¢, UTAH 53¢

8:00 PM EST

Golden Knights (16–7) vs Oilers (17–13) — VGK 45¢, EDM 56¢

🏀 NCAA Men’s Basketball — Top 25

12:00 PM EST

Colgate vs #23 Florida

1:00 PM EST

#13 Vanderbilt vs Wake Forest

2:00 PM EST

Kennesaw State vs #16 Alabama

3:00 PM EST

Gardner-Webb vs #20 Tennessee

4:00 PM EST

La Salle vs #2 Michigan

4:30 PM EST

#5 UConn vs DePaul

6:00 PM EST

Long Beach State vs #4 Iowa State

#7 Gonzaga vs Oregon

8:00 PM EST

North Dakota vs #15 Nebraska

🏀 NCAA Men’s Basketball — Additional

12:00 PM EST

Penn State (8–3) vs Pitt (6–6) — PENNST 52¢, PITT 50¢

Charleston (6–6) vs Northern Kentucky (9–4) — CHAR 39¢, NKENT 64¢

UMass Lowell (5–8) vs Boston University (4–8) — MASLOW 38¢, BOSTU 63¢

🐳 Polymarket Whales Today

$19,350 — No bought at 20¢ for Will Galatasaray SK win on 2025-12-21? by Substantial-Serv…

$23,052 — Team Spirit bought at 82¢ for Dota 2: Team Yandex vs Team Spirit (BO5) by redvinny

$11,325 — Chiefs bought at 60¢ for Chiefs vs. Titans by c4c4

$38,920 — Over bought at 59¢ for Aston Villa FC vs. Manchester United FC: O/U 2.5 by C.SIN

$26,274 — No bought at 72¢ for Will Manchester United FC win on 2025-12-21? by AlexanderTheBait

$28,967 — Over bought at 51¢ for Chiefs vs. Titans: O/U 37.5 by primm

🤩 New Markets

🗳️ NC-01 GOP Primary – Bobby Hanig leads Laurie Buckhout for the Republican nomination

🌵 AZ-01 Democratic Primary – Jonathan Treble vs. Marlene Galán-Woods in a tight race

🎾 ATP Grand Slam Winner (Next Year) – Novak Djokovic and Alexander Zverev are co-favorites

🎬 #2 Global Netflix Movie (This Week) – The Croods: A New Age is the clear favorite over My Secret Santa

📺 #2 Global Netflix Show (This Week) – Man vs Baby: Season 2 favored over Stranger Things 5

🏛️ House Vote on ACA Subsidies – Most likely outcome is passage with 215–229 votes

🐦 Elon Musk Tweets (Dec 23–30, 2025) – Extremely low activity expected (<40 tweets)

🎭 SAG Awards – Best Actress (Film) – Jessie Buckley favored over Renate Reinsve

🎭 SAG Awards – Best Comedy Ensemble – The Studio narrowly leads The Bear

📊 US Inflation (January, YoY) – Strong expectation inflation comes in ≤ 2.8%

🎟️ “Song Sung Blue” Opening Weekend Box Office – Most likely to debut under $7M

🎮 Play Games

We’ve built quick-hit games, but with a predictive twist. Sharpen your instinct for patterns, probabilities, and plays.

🎙️ The PNN Podcast

💸 What is PNN?

Prediction News Network delivers clear context and insight on tradable events.

We’re here to help you cash in on culture - the front page of tradable events, from the latest news to cultural context, and the market signals that tie them together. PNN coverage is informed both by the event itself and the current price, an intersection of culture and the market. For example:

Dancing experts believe Alix Earle is a near equal to Robert Irwin, a near coin flip winner, but markets give her only a 27% chance to win. Alix performs first, look to buy and flip quickly after her individual score as she is unlikely to secure the ultimate victory, but will be competitive the whole night.

Just like how Robinhood Snacks simplified financial news or Morning Brew made daily news digestible, we’re doing the same for prediction markets. PNN provides coverage of real-world events meeting real-time odds: cultural context and market movement in one place.

*This newsletter is for informational and entertainment purposes only. It does not constitute financial, investment, or betting advice. Always do your own research before making decisions. Prediction News Network and its contributors are not responsible for any actions taken based on this content. Prediction Market platforms (including Polymarket’s availability) legal status may vary by jurisdiction. U.S. access is subject to regulatory approvals and restrictions, which can change over time. Please review the official platform rules, terms, and applicable laws in your region before participating